QuickBooks Automated Sales Tax (Automate Sales Tax Online)

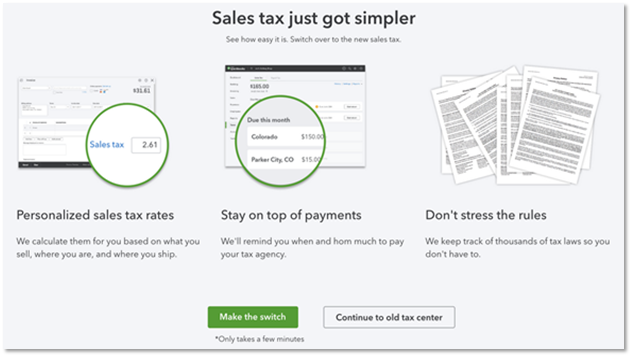

Every time it is little difficult to calculate sales tax with the accurate fillings. But those who are using the QuickBooks automated sales tax they have nothing to worry about the sales tax management. QuickBooks will calculate sales tax automatically. If you are a QuickBooks user, or just a visitor and have no idea about this automated tool then this tutorial is for you. In this tutorial, we will discuss the QuickBooks automates sales tax.

Save Time & Effort

Get Help From Expert

Get your accounting work done by experienced accountants. Fix all your accounting software errors & problems. Dial our toll-free number.

+1-844-476-5438As its name suggests automate the work of sales tax for this you have to fill some answers in the given box after that your sales tax is ready to use and you can automatically set up and track all your taxes. QuickBooks automated sales tax will help you to calculate your tax rate. Using QuickBooks AST you don’t need to do manual calculation all the stuff will be ready in a few minutes.

Setting Up of QuickBooks Automated Sales Tax

Read all the procedures, set up the tax according to your need.

How to Set Up Sales Tax in QuickBooks

- Firstly go into the QuickBooks then choose the “Taxes” after that click on “Set up sales tax”.

- Then you need to verify your business address after then click on Next.

- Then provide the information about your business fill all the information step by step and you can skip those boxes which do not have the asterisk (*) marks.

- Now you have to press the “Got it” button to confirm the setup.

Important: When you complete the setup then you will get the “permit no.” it will show on your checks and expenses transactions. So there is no such way to remove Permit No. If you don’t want to see on your checks and expenses transactions than you have to send a message for his click on the “Setting” and then choose “Feedback” and write I don’t want to see the Permit no. on my Checks and Transactions.

How to Calculate the QuickBooks Automated Sales Tax

In the new feature of QuickBooks Sales Tax Feature, you have to provide these details for calculating sales tax.

- The state where you have nexus and are enrolled to gather deals charge.

- It provides the feature of the “Physical Address” of your business.

- The physical address would be present in your invoices and sales receipt.

- Mapping of your product and services which you are selling.

- It also shows the status of your customers.

How QuickBooks know Which Tax Should be Calculated

Before calculating the tax QuickBooks collect different information under the guidance of the sales tax engine and some steps are given below.

- Firstly the tax engine considered the “Ship From” address.

- Then the tax engine considers Customers’ “Ship To” address.

- In that case, any customer does not have a shipping address then both sides “To and From” the company address will be used.

Sell Product to another State Customer

If your customer is located in another state then a problem of taxation arises how much we should apply because the tax differs from state to state for solving this problem you need to contact the state sales tax authority or an accountant for analyzing your situation. Below are some fundamental rules follow by every state-

- If you are not present in the state then you don’t need to collect sales tax.

- If you don’t have any data about the state what is sales tax rate then you can contact your local tax authority so they will help you.

- When you create a transaction without any QuickBooks automated sales tax setup then you will receive a message for adding your tax agency.

Note:- If you do not fill the customer’s address(street, state, and country) then QuickBooks will calculate tax according to your company.

How to Add Sales Tax for Shipping Charges

- QuickBooks provides the feature of automatically calculate your shipping charge according to the state or area.

- The sales tax center doesn’t provide the field to mark it as taxable, you need to set up manually after that you can use it into your transactions below are the steps of creating and use in the sales transaction.

Making Taxable Item/Services

- Hover the cursor on “Setting” then press the mouse left button then click on “Products and Services”.

- Here you have to click on New, then click on “Non-inventory” and “Services”.

- Then place the name, and select “Is taxable” checkbox.

- Don’t touch the “Price/rate” leave it default.

- After choosing any “Income Account” and click to “Save and Close”.

Use Taxable Item/services in the Sales Transaction

Firstly you need to add a shipping charge on sales transactions and then tap on the “Tax” button.

Sale Tax Exemption

Contact your state tax authority to inform them about your tax-exempt on the products and services some examples are given below:-

Resold Item – According to the few decades retailer does not pay any sales tax while the customer has to pap at the time of purchase. If you are working as a retailer then you need an exemption certification issued by the State.

Raw Material- Into the mostly state it is considered as sales tax exempt.

The non-profit organization- This organization takes relief from the tax they can sell their product in the state.

Types of exemption certificate-

- Federal Government

- State Government

- Local Government

- Tribal Government

- Charitable Organization – called as Non-Profit

- Religious Organization

- Educational Organization

- Hospital

- Resale

Final Thought

QuickBooks automated sales tax is an important feature of QuickBooks. You can handle your business in a smart in multiple cities. If you are running any type of business then you need to pay sales tax. Even wholesalers, retailers pay their taxes on time. QB automated sales tax will give you the feature of making your sales tax in just one click.

At last, we hope you like this article, still if you are seeking for help then you can get help from our QuickBooks experts to get the fast, and exact response to your problem.

Comments (0)